10 tips for successful social trading

Share:

You may have heard that the world of trading is becoming more and more accessible. The variety of tools and platforms is shockingly big and diversified. The latest industry trend is social trading as it allows to benefit from the features of a traditional social media combined with the tools for trading and investing. Novice traders can benefit from copying professional traders live trades and strategies.

So, what is social trading?

Social trading is a form of investing that allows investors to observe the trading behaviour of their peers and expert traders and to follow their investment strategies using auto copy trading activities. The World Economic Forum report has even called it a low-cost and sophisticated alternative to traditional wealth management.

Social trading introduces a new way of analyzing financial data by providing a ground to compare, comment and auto copy techniques and strategies. Traders can interact, watch others make trades, duplicate their trades and learn what incentivised the top performer to make a trade in the first place.

Let us give you the 10 tips that will help you feel comfortable within the new trend and “saddle” the “investing bull” of social trading.

1. Use auto-copying

2. Never forget tip #1

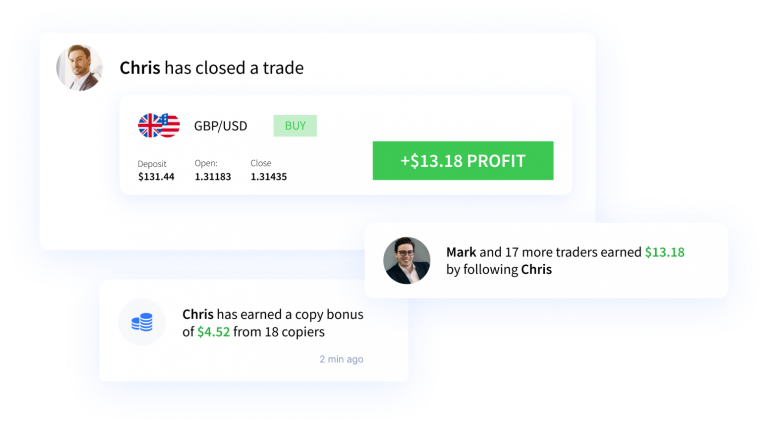

Indeed, auto-copying is the ongoing trend of 2019 that helps you get use of the analysis and strategic thinking of much more experienced traders than you are. Of course, it doesn’t mean this is a magic pill for successful investments, but it is a handy and useful tool that can save you lots of time and months of researching.

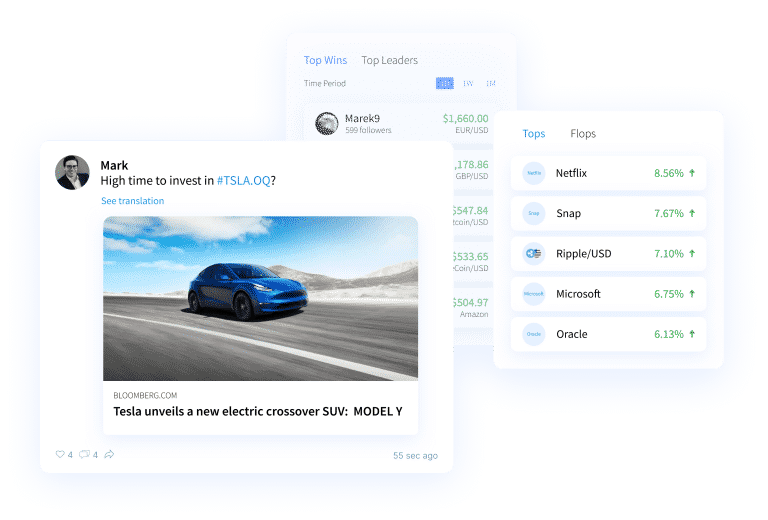

3. Don’t underestimate the social features when it comes to investing

We all know how difficult it can be for a newcomer to the financial markets without an experienced and supportive helping hand. It’s always easier to get a fast head-start when you can learn from leading traders just by following them on the platform.

NAGA offers a great variety of engagement options such as News Feed that helps you connect with other traders. You can comment, like or follow other users, all with one idea in mind: use the insights of experienced investors to develop your own trading style.

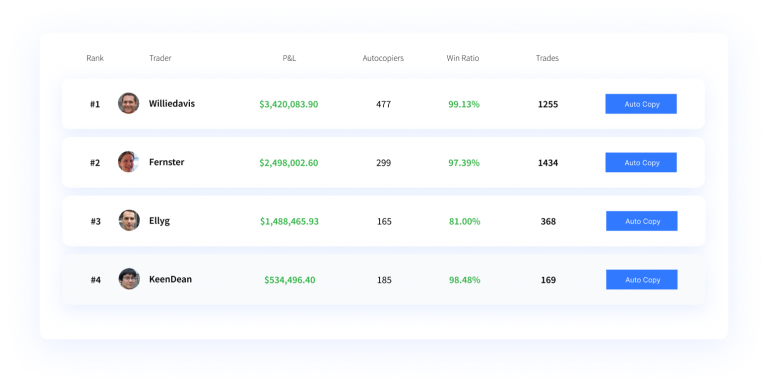

4. Follow the strategy of more than just one trader

While it is possible to have gains by copying only one trader, it is better to diversify your portfolio. Basically, by copying more traders, you are lowering your risk.

Remember: even the best traders have bad days, weeks or even months and they can also lose, so diversification is the key to minimizing your loss.

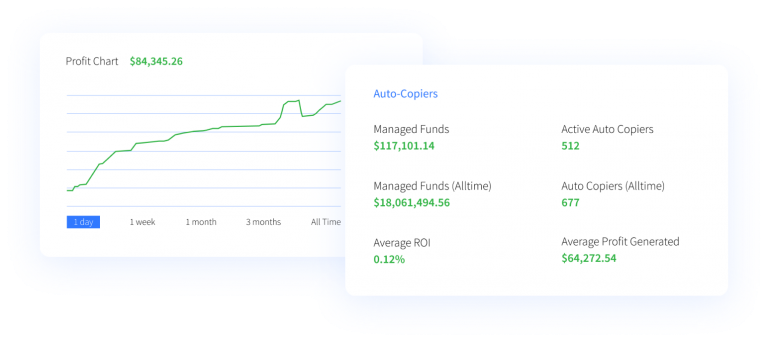

5. Do your own split-run testing

Try copying a couple of traders with smaller budgets and check which ones of them have bigger profits and ROI in the Stats section. It is best to use a minimum budget for that so that you minimise your risks as much as possible.

6. Avoid new and unverified users

New doesn’t always mean bad, but to be on the safe side it is always better to stick to this routine: Try auto-copying only verified users and the ones that already have a proven record of success, you can easily check the stats in their profile.

7. Following “Most Copied” isn’t always the right way to go

While the copiers with the highest profit&loss numbers and ROI seem to be the most logical target for copying, it is best sometimes to use filters in the Top Traders section to find the right trader with the strategy that has the same interests and risks as you do.

8. Never hesitate to stop

The best strategy is not to let the traders you copy reach 30% and more loss on the overall amount invested. So, if you see that things don’t feel right — just pull the plug and stop auto-copying the losing trades.

9. Reinvest your gains

Sometimes it is really tempting to withdraw your first profits and spend them on something nice for you, but never forget about compounding. To create wealth, you have to reinvest a percentage of your profits. That is the right strategy to stack and increase your profits over time.

10. Do your own research

Auto-copying is one of the best ways to trade and invest, but are you going to be satisfied with gains without even understanding how this all works? Today’s financial markets tend to be very dependant on market news. Any information or insight starting from big companies’ bankruptcy reports to even innocent tweets by a reckless CEO may affect the price drastically. Subscribe to NAGA’s highlighted news, follow our trading insights on social media, check the economic calendar and be prepared to become a trading expert yourself 😉

Share: